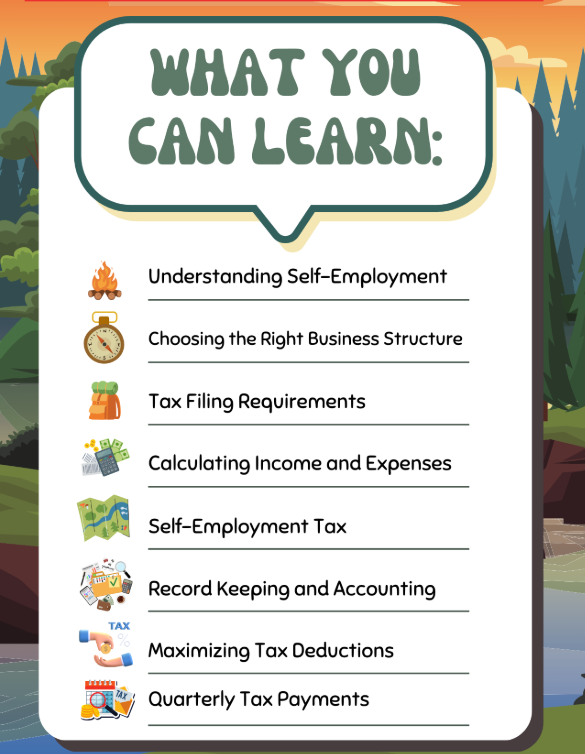

💯👏🏻Catina taught a lesson about small business and creator taxes during a UGC and Influencer marketing retreat, an area of business where many small business owners are left with a lot of unanswered questions, hear-say, and uncertainty about how to establish a business, what is the best entity option for them, quarterly and annual taxes, and so many other things that can be nuanced and uncertain. Over 18 of us walked away so much more knowledgeable and prepared to run our businesses, even myself! She is extremely knowledgeable, informative, provided handouts, and was eager to answer people's questions. She was incredible and we really enjoyed having her because she added SO much value.

Bri Walston